Over my time in finance, I've come across many ways of valuing companies - especially banks. From sitting through classes to applying a multiple on pre-tax, pre-provision profits at work, there are countless ways to value and monitor bank quality/profitiability.

One curious descrepancy I noticed recently while working with a dataset of bank data was the difference between net non-performing assets (NPA) and total non-performing assets. NPA is defined as "a debt obligation where the borrower has no paid any previously agreed upon interested and principal repayements to the designated lender for an extended period of time" (Investopedia).

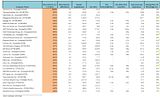

Banks usually classify loans past due into three categories: 30-89 days past due and still accruing, 90 days or more past due and still accruing, and nonaccrual. NPA figures come from the loans past due with nonaccrual status.

The difference between total NPA and net NPA is derived from the FDIC Loan Loss Sharing provision. A brief background of this provision can be found off an investment thesis I've written up:

FDIC introduced Loan Loss sharing into purchase and assumption (P&A) transactions in 1991, with the goals of: (1) sell as many assets as possible to the acquiring bank and (2) have the nonperforming assets managed and collected by the acquiring bank in a manner that aligned interests/incentives of FDIC and acquiring bank. Under loss sharing agreements, the FDIC agrees to absorb a significant portion of the loss (usually 80%) on a specified pool of assets while offering even greater loss protection in the event of financial catastrophe – the acquiring bank is liable for the remaining portion of the loss.The loan loss sharing agreement primarily covers commercial and real estate loans. The way it worked was that the FDIC absorbed credit losses over a period of time (3-5 years) during which the FDIC reimbursed the acquiring bank for 80% of the net charge-offs (charge-offs minus recoveries). During the shared recovery period, the acquiring bank pays the FDIC 80% of any recoveries on loss share assets previously experiencing a loss. The shared recovery period runs concurrently with the loss share period and lasts 1-3 years after the end of the loss share period.The agreement also includes a “transition amount” – if losses exceeded this projected amount, the FDIC would assume 95% of the losses and the acquiring bank would assume 5%. This provision addresses acquirer’s concerns about catastrophic losses resulting from limited due diligence time and uncertain collateral values stemming from deteriorating markets.

If you are looking through quarterly filings, be sure you know which NPA you are looking at - total or net. Usually a bank will report one or the other - either only total NPA or only net NPA with a footnote explaining why they chose net NPA. These figures do not mean the same thing, thus inconsisencies arise when running screens and calculations - as it is not exactly an apples-to-apples comparison and there are undisclosed assumptions made which are not published.

Furthermore, I've checked with the major data vendors, and their data does not make any distinction between net and total NPA. XBRL formats record the numbers interchangeably - net as total NPA when available.

If you're interested in learning more about net vs total NPA's, implications, and access to both total and NPA figures for banks that only publish net NPA (no instances I've found where they'll publish only total when they can publish net NPA) - please contact me and I'll be glad to share.